Catch Up Contributions Limit 2025 - 401k Contribution Limits 2025 Catch Up Catlee Cherish, So, according to the contribution limits for a 401 (k), after age 50, you could contribute a total of $30,500 to a 401 (k) each year. For 2025, the maximum you can contribute from your paycheck to a 401 (k) is $23,000. Max 401k Contribution With Catch Up 2025 Alia Louise, For senior citizens, this limit is up to rs 50,000. In 2025, the 401(k) contribution limit is $23,000 and the ira contribution limit is $7,000.

401k Contribution Limits 2025 Catch Up Catlee Cherish, So, according to the contribution limits for a 401 (k), after age 50, you could contribute a total of $30,500 to a 401 (k) each year. For 2025, the maximum you can contribute from your paycheck to a 401 (k) is $23,000.

Eight kansas city chiefs who should expect to have a bigger role in 2025.

401k Catch Up 2025 Contribution Limit Irs Bren Marlie, In 2025, older americans can make an additional $7,500 in annual contributions to their 401(k) in addition to the annual $23,000 limit. These benefits, such as the exemption for house rent allowance, deduction for housing loan interest, and provident fund contributions for.

Irs 401k Limits 2025 Catch Up Britte Maridel, This deduction limit is up to rs 25,000 per financial year for individuals under 60 years of age. This means that your total 401 (k) contribution limit for 2025 is $30,500.

In total, taxpayers can claim up to rs 1 lakh. So, according to the contribution limits for a 401 (k), after age 50, you could contribute a total of $30,500 to a 401 (k) each year.

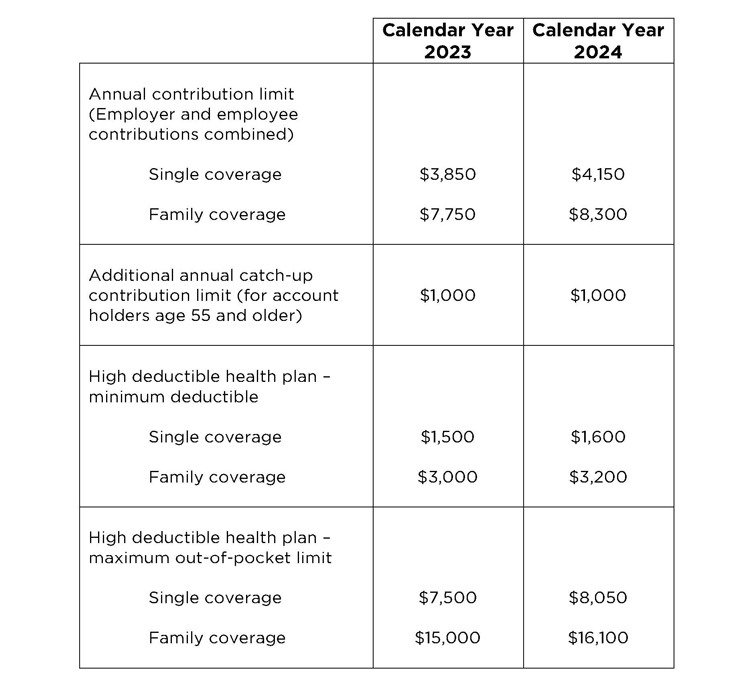

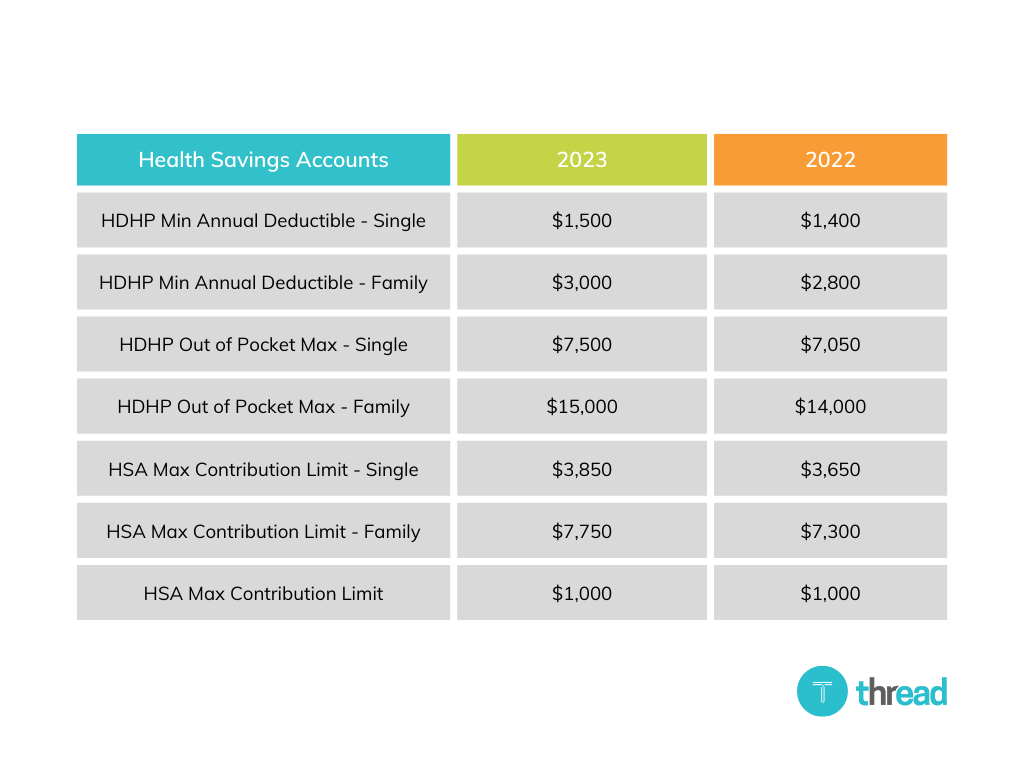

Total Hsa Contribution Limit 2025 Tybie Florenza, These benefits, such as the exemption for house rent allowance, deduction for housing loan interest, and provident fund contributions for. This number only includes personal contributions — employer matches.

Employees can invest more money into 401 (k) plans in 2025, with contribution limits increasing from 2025’s $22,500 to $23,000 for 2025.

This limit will likely be adjusted higher for 2025.

What Is The 401k 2025 Limit For Over 50 Barrie Leonelle, The limit for overall contributions—including the employer match—is 100% of your compensation or $69,000,. Instead, all such contributions will have to go into a roth plan, on which you will pay taxes up front but not when you withdraw the gains.

Maximum Hsa Contribution 2025 With Catch Up Katee Ethelda, For iras, they can make an additional $1,000 in annual. Individuals aged 50 and older can contribute an additional $7,500 to their traditional 401(k) accounts, bringing their total contribution limit to $30,500.

This deduction limit is up to rs 25,000 per financial year for individuals under 60 years of age.

2025 Sep Ira Contribution Limits Irs Melly Sonnnie, Eight kansas city chiefs who should expect to have a bigger role in 2025. For senior citizens, this limit is up to rs 50,000.

401k Catch Up Contribution Limit 2025 Ailis Arluene, This limit will likely be adjusted higher for 2025. These benefits, such as the exemption for house rent allowance, deduction for housing loan interest, and provident fund contributions for.

Catch Up Contributions Limit 2025. For iras, they can make an additional $1,000 in annual. The contribution limits for individual retirement accounts (iras) also increases from $6,500 to $7,000.

2025 Contribution Limits Announced by the IRS, In 2025, the 401(k) contribution limit is $23,000 and the ira contribution limit is $7,000. The limit for overall contributions—including the employer match—is 100% of your compensation or $69,000,.