Minimum Income To File Tax Return 2024 - Minimum income to file taxes for the 2024 tax year. Which Type of Tax Return Do I File? Tax IndiaFilings, Taxpayers have until july 31, 2024, to file returns. Page last reviewed or updated:

Minimum income to file taxes for the 2024 tax year.

Filed your ITR? Check 5 types of ITR filing status, Page last reviewed or updated: Now, i would like to apprise you the precautions while filing income tax returns for individuals:

Tax Return (ITR) Filing Aapka Consultant, Who must file a tax return: Taxpayers have until july 31, 2024, to file returns.

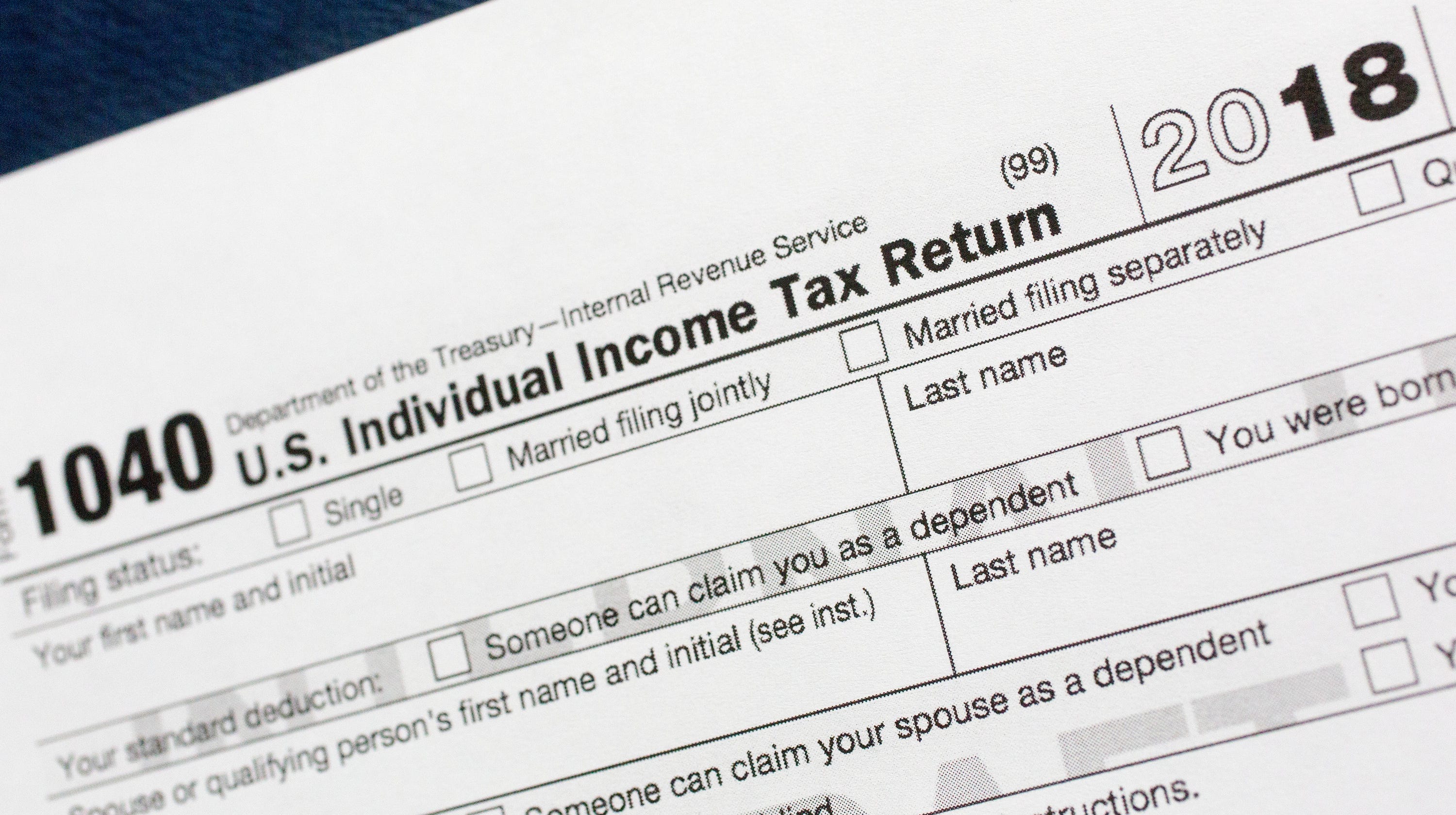

This is the minimum for taxpayers to file their 2023 tax return, Income tax return (itr) is a form in which the taxpayers file information about their. You probably have to file a tax return in 2024 if your 2023 gross income was at least $13,850 as a single filer or $27,700 if married filing jointly.

Taxpayers have until july 31, 2024, to file returns. Keep records for six years if you do not report.

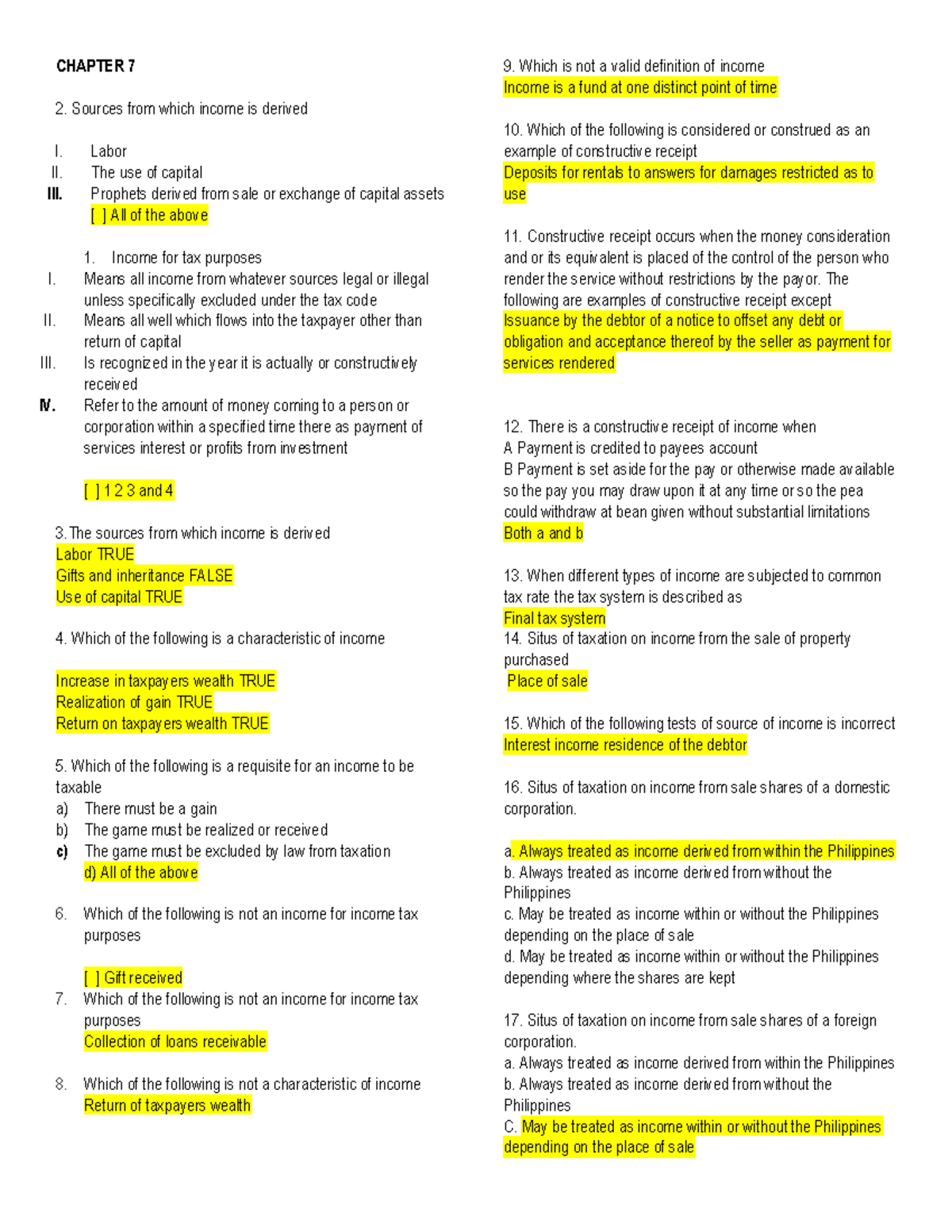

78 TAXATION CHAPTER 78 SOLMAN WITH QUESTIONS CHAPTER 7, Choosing the appropriate income tax return (itr) form is crucial for both individuals and businesses.this ensures compliance. Single and 65 or older:

Minimum To File Taxes 2021, For filing itrs, pan cards are a must. Minimum income amounts to file taxes.

Filing your NY tax returns Tips on what you need to know in 2019, Head of household and 65. Citizens and permanent residents who work in the united states need to file a.

Citizens and permanent residents who work in the united states need to file a.

Minimum Income To File Tax Return 2024. In 2024, when filing as “single”, you need to file a tax return if your gross income level in 2023 was at least: Head of household and 65.

How To File Tax Returns Online In Pakistan Zameen Blog, Find out if you have to file a. Single and 65 or older:

Tax Return for FY 202324 Last Date and Deadline; Easy and, Taxpayers have until july 31, 2024, to file returns. For the 2024 tax year, the irs has raised the standard deduction to reflect inflation adjustments.

If you're a surviving spouse or estate executor for someone who died in, This return is applicable for a resident (other than not ordinarily resident) individual having total income from any of the following. Head of household and under 65: